How Much In Medical Expenses For A Tax Deduction 2025. You can deduct medical expenses that exceed 7.5% of your adjusted gross income (agi). For the highest tax rate of 30%, the tax saved is rs 7,800 (including cess).

Through 2025, taxpayers who itemize their tax deductions can claim a deduction on their federal tax return up to $10,000 each year for. How much medical expenses are deductible 2025.

Medical expenses are deductible only to the extent the total exceeds 7.5% of your adjusted gross income (agi).

If you incurred $8,000 in medical expenses, you can deduct only $500 worth of those expenses on your taxes, which is your expenses over $7,500.

Medical Expenses Tax Deduction Ppt Powerpoint Summary Example Topics, To calculate your gross taxable income, you need to compute your net salary after subtracting your deductions, such as hra, lta, and standard. 1.section 80ddb offers a beneficial tax deduction for medical expenses for treatment of specified diseases.

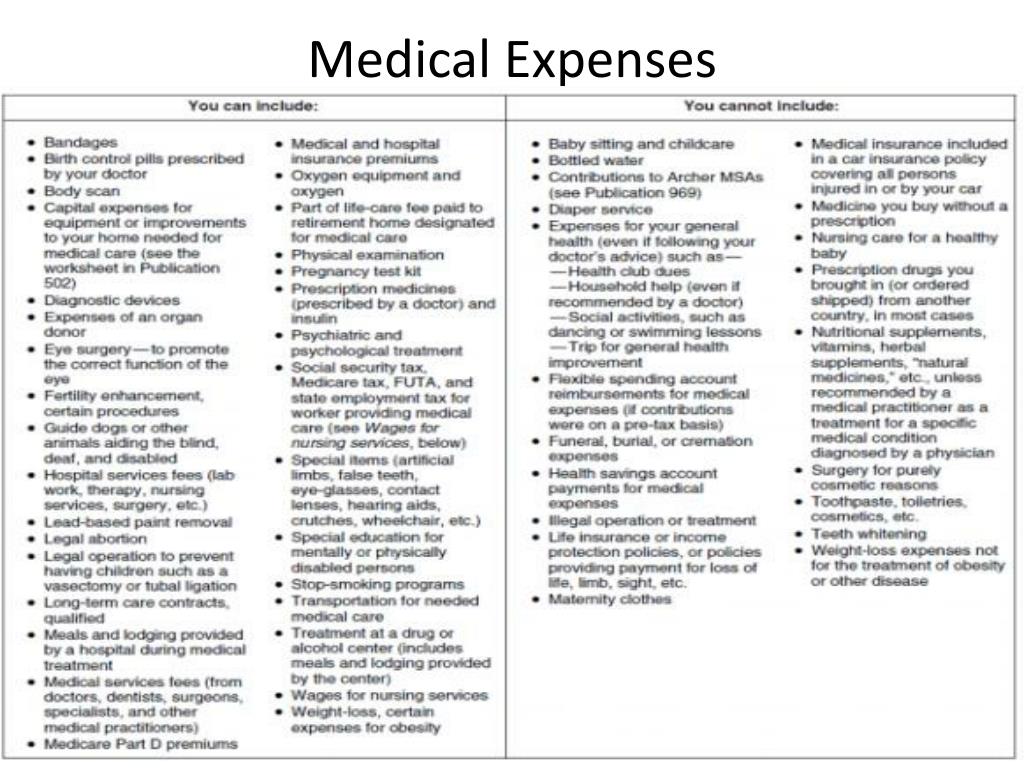

Medical Expenses You Can Deduct From Your Taxes Medical, Tax time, Medical expenses are deductible only to the extent the total exceeds 7.5% of your adjusted gross income (agi). If you itemize your deductions for a taxable year on schedule a (form 1040), itemized deductions, you may be able to deduct the medical and dental.

Tax deductions for medical expenses YouTube, Under section 80d of the income tax act, 1961, individuals and hindu undivided families (huf) get tax deduction benefits for buying health insurance. Besides medical coverage, health insurance plans can provide tax benefits to you.

Medical expenses deduction How much can you actually deduct? Marca, If you itemize deductions, and you have unreimbursed expenses for necessary medical or dental care, you may be able to claim a tax deduction if they. How much medical expenses are deductible 2025.

Medical Expenses Tax Deduction Vakilsearch, Besides medical coverage, health insurance plans can provide tax benefits to you. You can deduct medical expenses that exceed 7.5% of your adjusted gross income (agi).

Medical Expenses Checklist TurboTax Tax Tips & Videos Tax, According to section 80d of the income tax act, senior citizens may avail a higher deduction of up to ₹ 50,000 for payment of premium towards medical insurance policy. For example, if you itemize, your agi is $100,000.

Do you have a lot of medical expenses in the US? Learn how to deduct, 75,000 to a resident individual who, at any time during the previous year, is certified by the medical authority to be a person with disability [as. For the highest tax rate of 30%, the tax saved is rs 7,800 (including cess).

Yearend planning for medical expense claims Akler Browning LLP, How much medical expenses are deductible 2025. Deduction in respect of expenses towards medical treatment.

PPT Standard Deduction & Itemized Deductions PowerPoint Presentation, Medical expenses are deductible only to the extent the total exceeds 7.5% of your adjusted gross income (agi). You can deduct medical expenses that exceed 7.5% of your adjusted gross income (agi).

Medical expenses tax deductible xtremehooli, Besides medical coverage, health insurance plans can provide tax benefits to you. The premium paid towards medical insurance can be claimed as health.

To calculate your gross taxable income, you need to compute your net salary after subtracting your deductions, such as hra, lta, and standard.

If you itemize deductions, and you have unreimbursed expenses for necessary medical or dental care, you may be able to claim a tax deduction if they.